If you’re a business owner in Tanzania, understanding the TRA (Tanzania Revenue Authority) taxpayer registration and taxpayer login process is essential. The TRA plays a crucial role in collecting taxes and ensuring compliance with tax laws in the country. In this blog post, we will guide you through the steps of registering as a taxpayer with the TRA and how to navigate the taxpayer login portal. We’ll cover everything from the required documents to the online registration process, so you can easily fulfill your tax obligations and stay on top of your financial responsibilities. Don’t let tax-related confusion hold back your business – read on to become an expert on TRA taxpayer registration and login!

Understanding TRA Taxpayer Registration

When you’re looking to register as a taxpayer with the Tanzania Revenue Authority (TRA), the process is straightforward. Think of it as setting up your own account in a digital tax world. Here’s how it typically goes:

Step-by-Step Guide to TRA Taxpayer Portal Login

Once registered, TRA Taxpayer Login is your next stop. It’s like having a key to your own personal tax office. You can enter whenever you want and manage your tax affairs with ease.

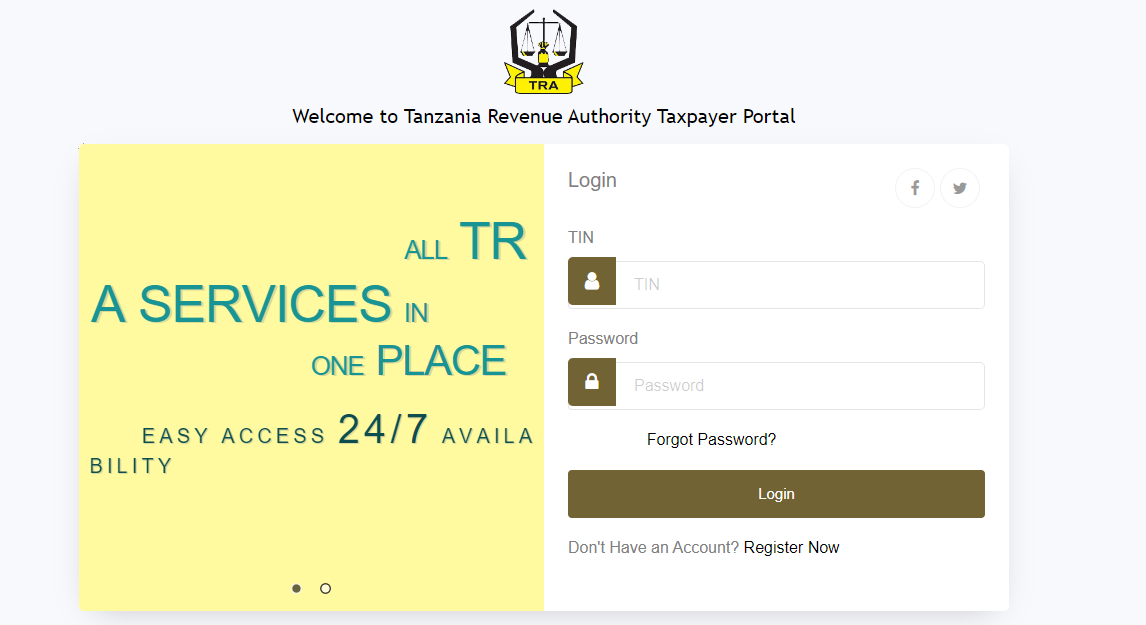

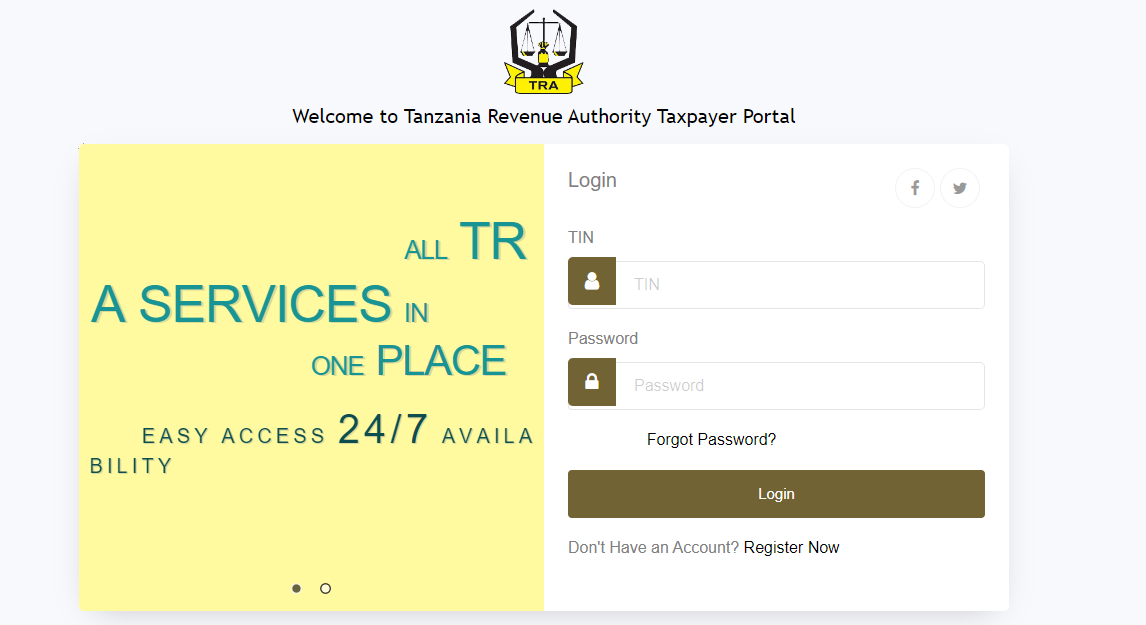

Accessing the Portal

- Portal URL: First, go to the TRA Taxpayer Portal by visiting taxpayerportal.tra.go.tz. This is your entry point to a range of tax services.

- Login Page: Once you’re on the site, you’ll be greeted with the login page, where you’ll need to enter your credentials to access the portal’s services.

Logging In

- Enter Your TIN: Start by entering your Taxpayer Identification Number (TIN) in the TIN field. This is your unique identifier in the TRA system.

- Enter Your Password: Next, input your password in the Password field. Make sure you enter it correctly to avoid access issues.

- Trouble Logging In?: If you’ve forgotten your password, there’s no need to worry. Just click on ‘Forgot Password?’ to initiate the password recovery process.

- Completing the Login: After entering your TIN and password, click on the ‘Login’ button to proceed to your dashboard.

TRA Taxpayer Registration: Your First Step

Imagine you’re setting out on a journey in the world of taxation. Your first destination is TRA Taxpayer Registration. This is where you establish your identity in the TRA system. It’s like getting your passport for tax-related matters.

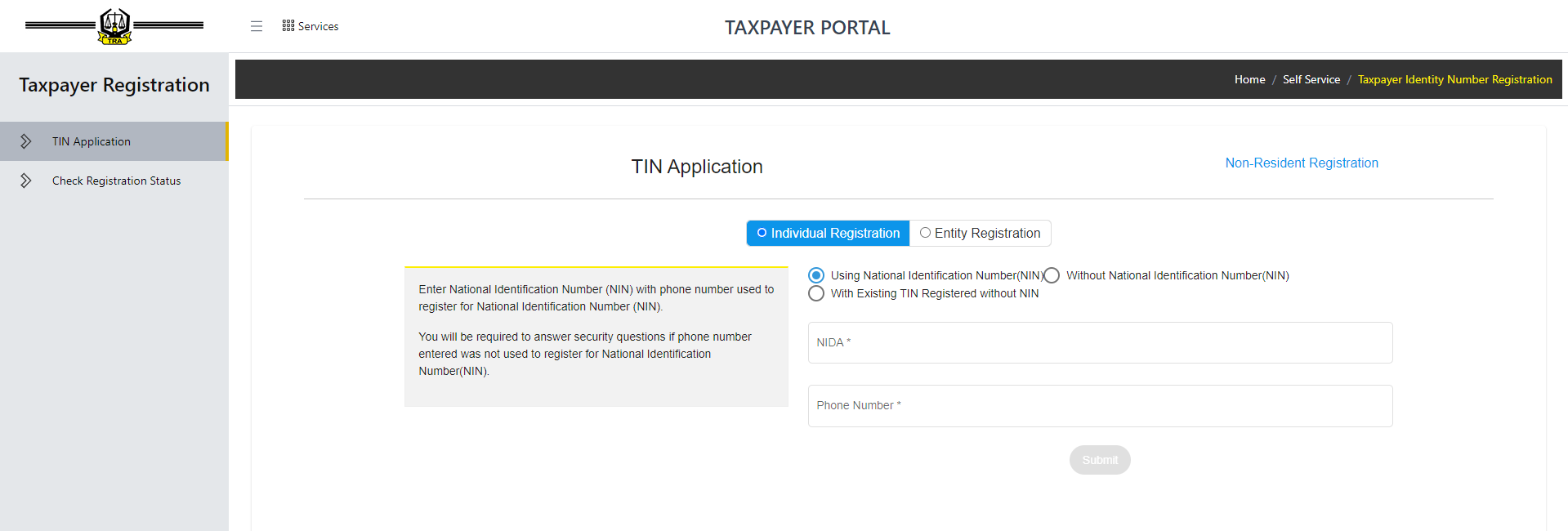

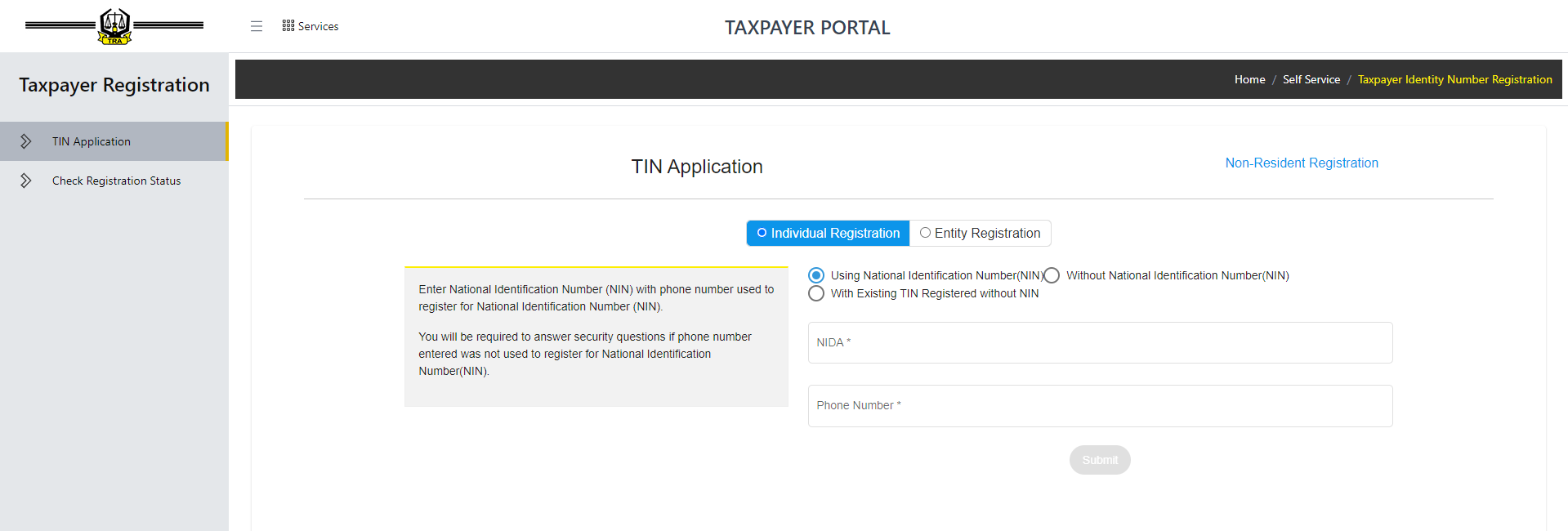

Accessing the Taxpayer Portal

- Start Here: Visit the TRA Taxpayer Portal at TAXPAYER PORTAL. Once there, navigate to the ‘Self Service’ section and select ‘Taxpayer Identity Number Registration’.

Choosing Your Registration Type

- Individual Registration: If you’re an individual looking to register, select ‘Individual Registration’.

- Entity Registration: For businesses or entities, choose ‘Entity Registration’.

Entering Identification Details

- National Identification Number (NIN): Enter your NIN along with the phone number used for NIN registration.

- Without NIN: If you don’t have a NIN, there’s an option to proceed without it.

- Existing TIN without NIN: For those who have an existing TIN registered without a NIN, there’s a specific process to follow.

Security Questions

- Verification: In cases where the phone number entered differs from the one used for NIN registration, you’ll be required to answer security questions for verification purposes.

NIDA and Phone Number

- NIDA Verification: Enter your NIDA details (marked with an asterisk as mandatory).

- Contact Details: Provide a valid phone number for communication and verification.

Submission

- Review and Submit: Once all the information is entered, review it for accuracy and then hit the ‘Submit’ button.

Checking Registration Status

Services Section

- After applying for your TIN, you can check the status of your registration through the ‘Services’ section on the portal. This feature keeps you updated on the progress of your application.

After Logging In

- Integrated Services: Once logged in, you’ll have access to all TRA services in one place. This includes filing tax returns, applying for TIN, tracking cargo, and much more.

- User-Friendly Dashboard: The portal’s dashboard is designed to be user-friendly, making it easy to find and access the services you need.

- 24/7 Availability: One of the best things about the TRA Taxpayer Portal is its 24/7 availability, allowing you to manage your tax affairs at any time that’s convenient for you.

In conclusion, TRA Taxpayer Registration and TRA Taxpayer Login are the foundational steps for managing your taxes online. They empower you to take control of your tax affairs efficiently and conveniently. Remember, registration is your entry point, and login is your continual access to this digital tax realm.

OR Visit mabumbe Homepage To Get Relevant Topics.