As taxpayers, it is crucial to have a clear understanding of how our contributions are utilized and the various calculations involved. The Tanzania Revenue Authority (TRA) provides calculators for different purposes, including calculating income tax (PAYE), vehicle values, and more. In this comprehensive guide, we will delve into the TRA calculators, tax collection, focusing on the TRA Pay As You Earn (PAYE) calculator and the TRA used car value calculator. So, let’s get started!

Understanding the TRA Pay As You Earn (PAYE) Calculator

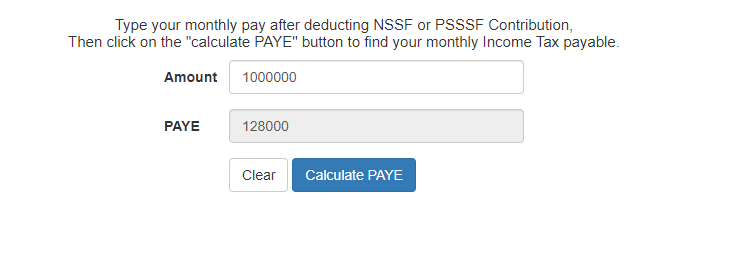

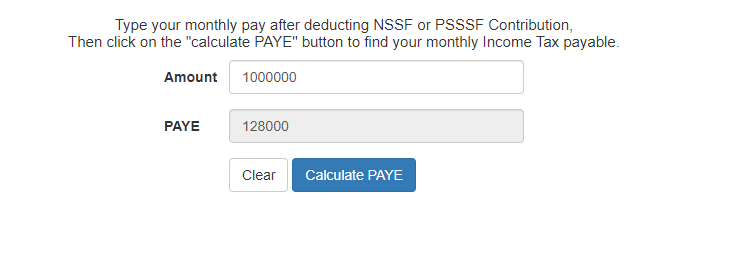

The TRA Pay As You Earn (PAYE) calculator is an essential tool for employees to determine the amount of income tax they need to pay based on their monthly earnings. By inputting the necessary details into the calculator, such as the monthly pay after deducting NSSF or PSSSF contributions, employees can quickly and accurately calculate their monthly income tax payable.

How to Use the TRA PAYE Calculator

To use the TRA PAYE calculator, follow these simple steps:

- Visit

- Enter the amount of your monthly pay after deducting NSSF or PSSSF contributions.

- Click on the “calculate PAYE” button.

- The calculator will display the calculated PAYE amount.

Check here TRA PAYE calculator

Here’s an example to illustrate the process:

Amount | PAYE |

Monthly Pay | TZS 1000000 |

NSSF/PSSSF Contribution | TZS 300 |

Total Deductions | TZS 300 |

Net Pay | TZS 2,200 |

Income Tax Payable | TZS 128000 |

Key Features of the TRA PAYE Calculator

The TRA PAYE calculator offers several key features to facilitate accurate tax calculations:

- Convenience: The calculator is easily accessible online, allowing users to calculate their income tax from the comfort of their own homes or workplaces.

- Time-saving: By automating the calculation process, the calculator saves considerable time and effort for employees, ensuring accurate results within seconds.

- Accuracy: The TRA PAYE calculator follows the tax regulations set by the Tanzania Revenue Authority, ensuring precise calculations that comply with the tax laws.

- Transparency: By providing a breakdown of the calculations, the calculator promotes transparency, allowing employees to understand how their income tax is computed.

Calculating Vehicle Value with the TRA Used Car Value Calculator

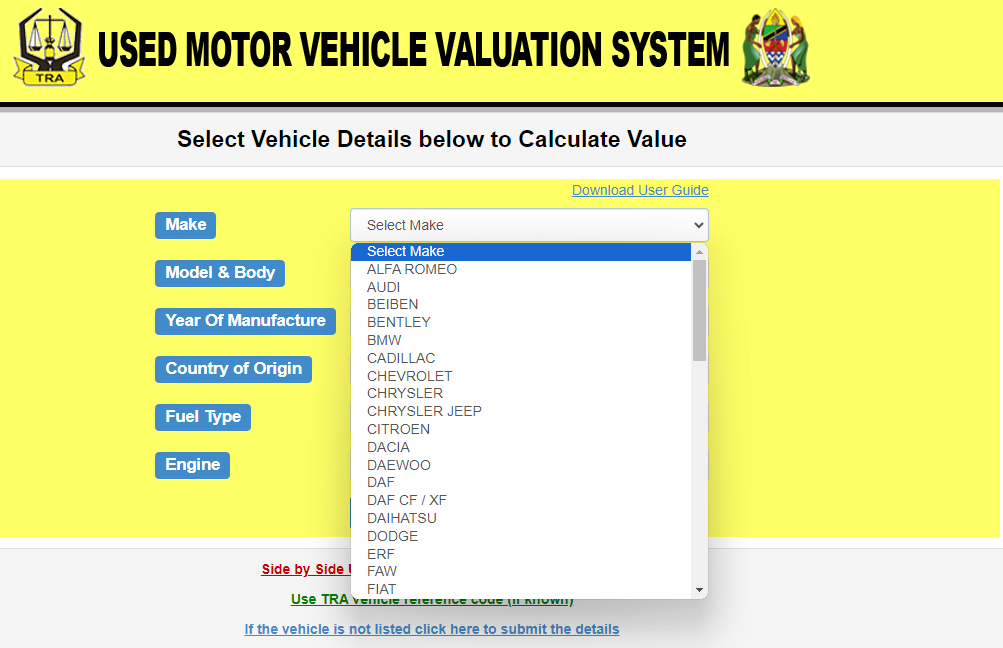

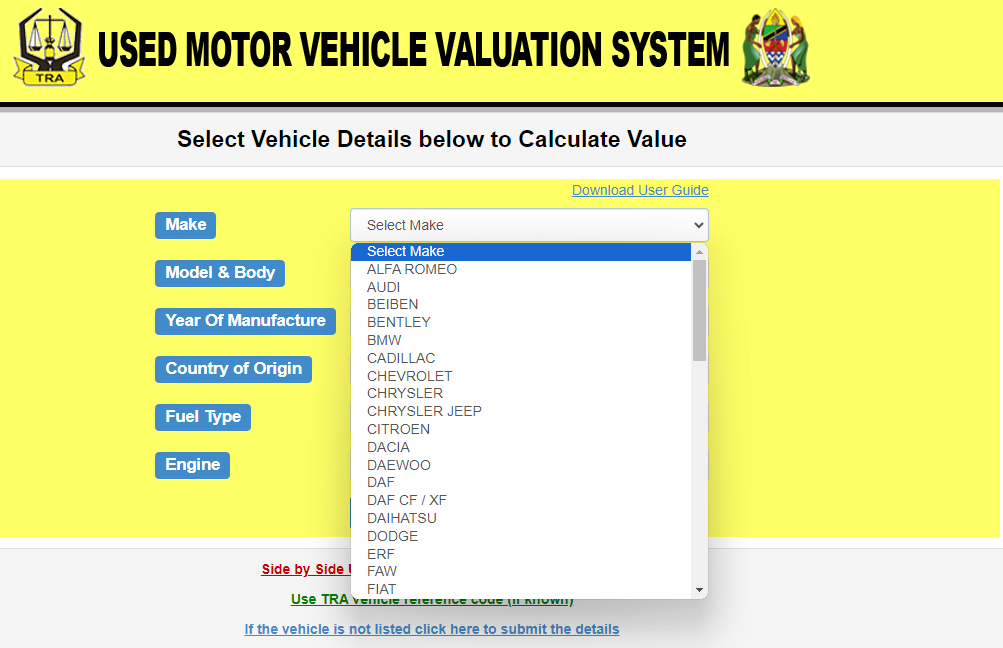

If you are planning to buy or sell a used vehicle in Tanzania, it is essential to determine its value accurately. The TRA used car value calculator is designed to assist individuals in calculating the fair market value of used vehicles, using the TRA vehicle reference code.

How to Use the TRA Used Car Value Calculator

To calculate the value of a used vehicle using the TRA calculator the motor vehicle valuation system, follow these steps:

- Visit

- Select the make and model of the vehicle, along with its body type and year of manufacture.

- Specify the country of origin of the vehicle.

- Choose the fuel type and engine size.

- Enter the TRA vehicle reference code if known. If the vehicle is not listed, there is an option to submit the details for further assistance.

Check here TRA Used Car Value Calculator

Key Benefits of the TRA used car calculator

The TRA used car value calculator offers several advantages for buyers and sellers of used vehicles:

- Fair Market Value: By utilizing the TRA calculator, individuals can determine the fair market value of used vehicles, ensuring a fair and transparent transaction.

- Accurate Assessments: The calculator takes into account various factors such as make, model, body type, year of manufacture, country of origin, fuel type, and engine size to provide accurate vehicle valuations.

- Informed Decisions: Armed with the calculated value, buyers and sellers can make informed decisions regarding the purchase or sale of used vehicles, ensuring a fair deal for all parties involved.

Additional Information: Exploring the TRA Tanzania Calculator

Apart from the TRA PAYE calculator and the TRA used car value calculator, the Tanzania Revenue Authority offers a range of other calculators to assist taxpayers in various calculations. These include:

- Income Tax Calculator: Allows individuals to calculate their income tax based on different income sources and tax reliefs.

- Property Tax Calculator: Helps property owners determine the amount of property tax they need to pay based on the assessed value of their properties.

- Customs Duty Calculator: Assists individuals in calculating the customs duty payable for importing goods into Tanzania.

- Value Added Tax (VAT) Calculator: Enables businesses to calculate the amount of VAT they need to charge or pay based on their sales and purchases.

By utilizing these calculators, taxpayers can ensure accurate calculations, comply with tax laws, and make informed financial decisions.

How can a TRA calculator help with financial planning?

A TRA calculator can help with financial planning by providing accurate estimates of taxes and the value of a vehicle. This information allows individuals to make informed decisions about budgeting, purchasing, and selling vehicles, ultimately helping them plan for their financial future more effectively.

OR Visit mabumbe Homepage To Get Relevant Topics.

Conclusion

The TRA calculators, including the TRA PAYE calculator and the TRA used car value calculator, are valuable tools for individuals and businesses in Tanzania. By providing accurate calculations and promoting transparency, these calculators empower taxpayers to understand their tax liabilities and make informed financial decisions. Whether it’s calculating income tax or determining the value of a used vehicle, the TRA calculators are indispensable resources for taxpayers in Tanzania.

Remember, staying informed about tax calculations and utilizing the TRA calculators can help you navigate the intricacies of taxation and ensure compliance with the tax laws of Tanzania. So, make the most of these calculators and take control of your financial responsibilities today this calculators are used by Tanzania, and not Kenya, Uganda or any other country!